Background: The primary driver of hospital acquisitions is desire to increase market share. While financial impacts of hospital mergers are well demonstrated and include cost savings and economies of scale, quality impacts are less clear. A systematic review conducted through January 2020 reported inconsistent findings and few statistically significant results of hospital mergers on healthcare quality measures. Additional studies are needed to assess the impact of hospital mergers on quality of care. The purpose of our study is to understand the effect of recent Medical University of South Carolina (MUSC) Health regional hospital acquisitions on healthcare quality and to identify future opportunities to improve patient care.

Methods: A pre/post-acquisition observation study was performed assessing quality measures of five hospitals within MUSC Health’s Regional Health Network (RHN) recently acquired between 2019 and 2021. Given reporting limitations in Leapfrog Hospital Safety Grades, CMS Overall Star Ratings, and CMS Patient Experience Star Ratings, we utilized Vizient® data to allow accurate, real-time data analysis. Outcome measures included change in rank of overall Vizient® hospital rank, mortality, safety, and patient centeredness. Vizient® Quality and Accountability (Q&A) data sheets were used to compare pre/post-acquisition data.Pre-acquisition data was defined as metrics obtained within 6 months immediately following acquisition. Post-acquisition data was defined as metrics obtained ≥1 year following acquisition. Efficiency and efficacy measures included on the Q&A were excluded in the analysis, as these measures reflected finance and operations more than quality. Raw ranks were adjusted to percentile ranks, as the number of hospitals in Vizient® cohorts varied each year, with lower percentile rank indicating improvement.

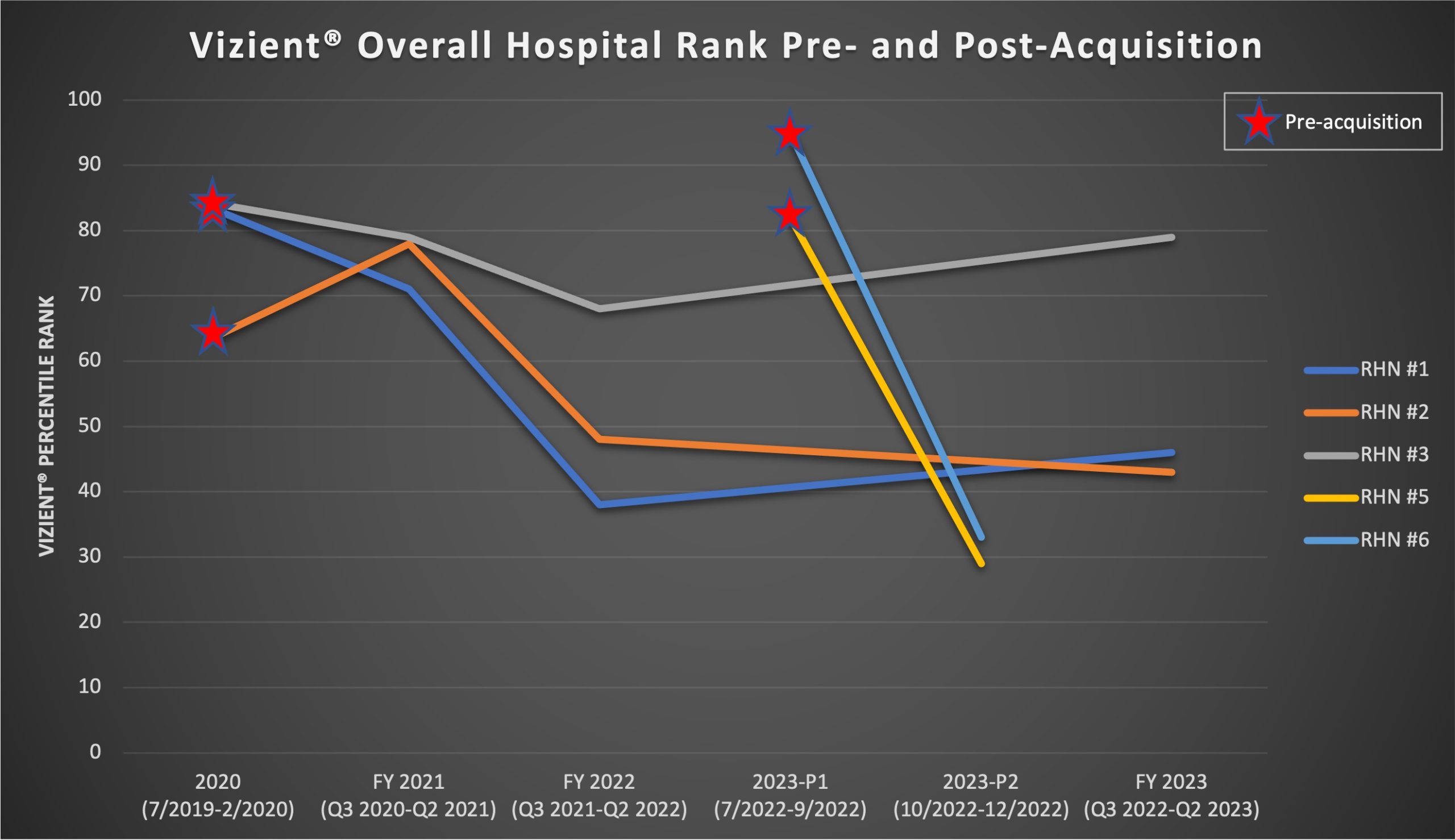

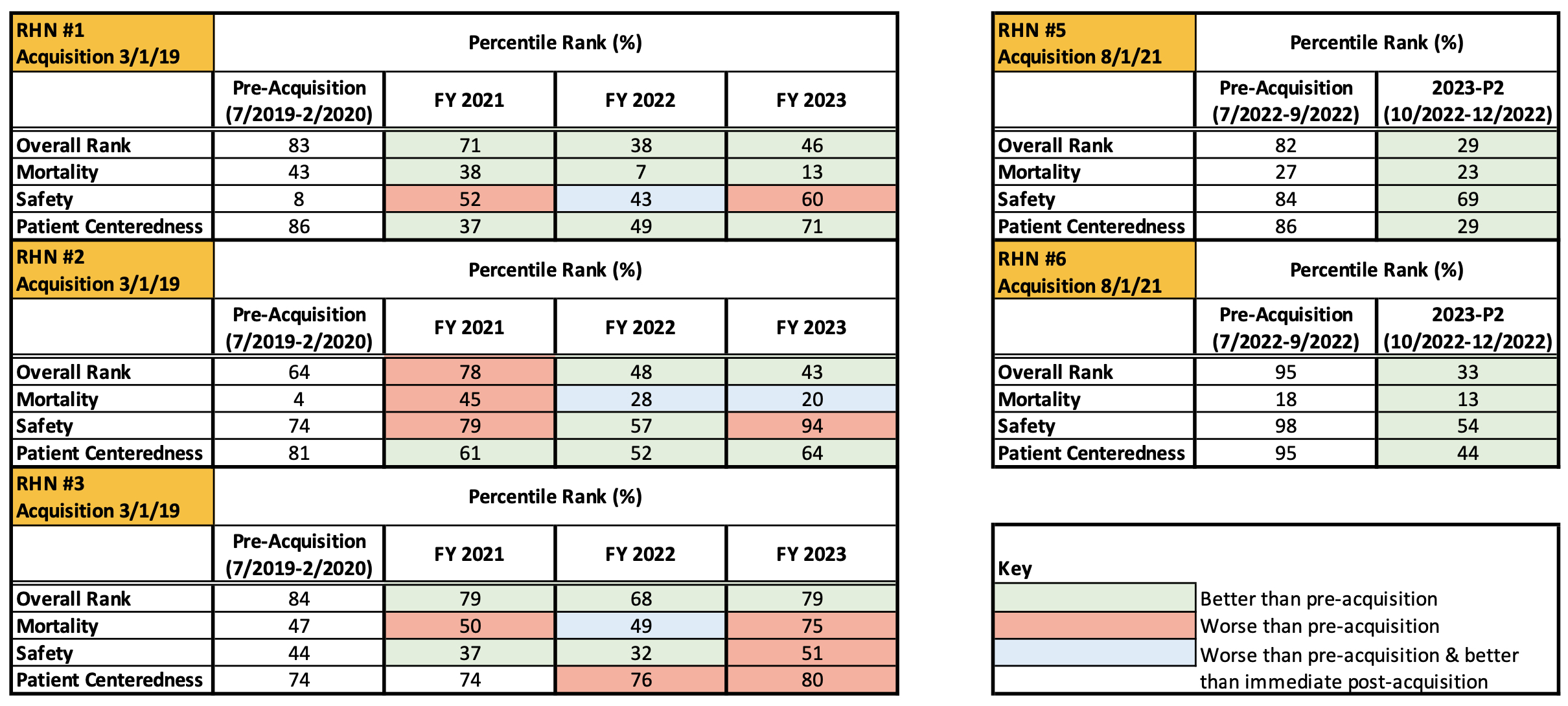

Results: MUSC Health acquired six regional hospitals between 2019 and 2021: four in 2019 and two in 2021. Given the small size and paucity of comparable data, one regional hospital (RHN #4) was excluded in the analysis. Overall Vizient® percentile rank is improving post-acquisition for all five regional hospitals (Figure 1).Individual Vizient® outcome measures show mixed results based on timing of acquisition and the specific hospital (Figure 2). Safety percentile rank is worse for the three RHNs acquired in 2019 yet improved for the two RHNs acquired in 2021. RHN #3 appears to be an outlier, as it demonstrates worse percentile ranks for mortality, safety, and patient centeredness. Mortality, safety, and patient centeredness are improving post-acquisition at RHN #5 and RHN #6, which are the two newest acquisitions.

Conclusions: All five MUSC regional hospital acquisitions show currently improving overall percentile rank, with 4 of 5 hospitals currently better than average (below 50th percentile). Individual quality outcomes vary in association with acquisition. Safety is worse for earlier acquisitions, noting that the pre/post-acquisition timeline spanned the Covid-19 pandemic, during which hospital-acquired conditions worsened nationally. More recent acquisitions show improved post-acquisition quality measures, suggesting lessons learned from earlier acquisitions, as well as system-level standardization with implementation of governed management plans. One hospital appears to be an outlier. Further detailed dive into each hospital using quantitative and qualitative analysis is required to understand drivers of individual outcomes.