Background: The United States healthcare system has witnessed an overwhelming trend towards mergers of hospitals and acquisitions, with the proportion of primary care physicians working in hospital – or healthcare system-owned organizations increasing from 28% to 44% from 2010 to 2016. Existing evidence suggests this consolidation has driven higher costs but has had mixed effects on quality. This study investigates the relationship between hospital market concentration and healthcare value. We hypothesized that hospitals in more concentrated markets would deliver lower value care.

Methods: Using Centers for Medicare and Medicaid Services (CMS) Overall Hospital Quality Star Ratings, which rates hospital performance by pooling 57 quality measures, and Medicare spending per beneficiary (MSPB), a value measure was derived. The value score for a hospital was defined as the difference between its star score and standardized MSPB score, with each score standardized to range from 0 – 10; thus, the maximum value score was 10 and minimum -10. Hospital market concentration was determined using the Health Care Cost Institute (HCCI): Hospital Concentration Index dataset, which provides the Herfindahl-Hirschman Index (HHI), a validated calculation for market concentration, in 186 Core-Based Statistical Areas (CBSAs) representing over 240 million individuals. The index was created using HCCI’s inpatient health care claims data from individuals under 65 receiving commercial health insurance through their employer between 2017 and 2021. Hospital level characteristics, including geography, ownership, teaching status, and Medicare and Medicaid patient percentage, were obtained through the American Hospital Association 2020 survey. A zip code to CBSA crosswalk across the United States was used to map hospitals to CBSAs and their corresponding HHI values. We summarized hospital value by concentration group. To assess the association of HHI with value, we estimated two mixed effects linear regression models with value (high vs other) as dependent variable and HHI as independent variable, with a random effect for CBSA. The first model included only HHI, the second also included hospital characteristics.

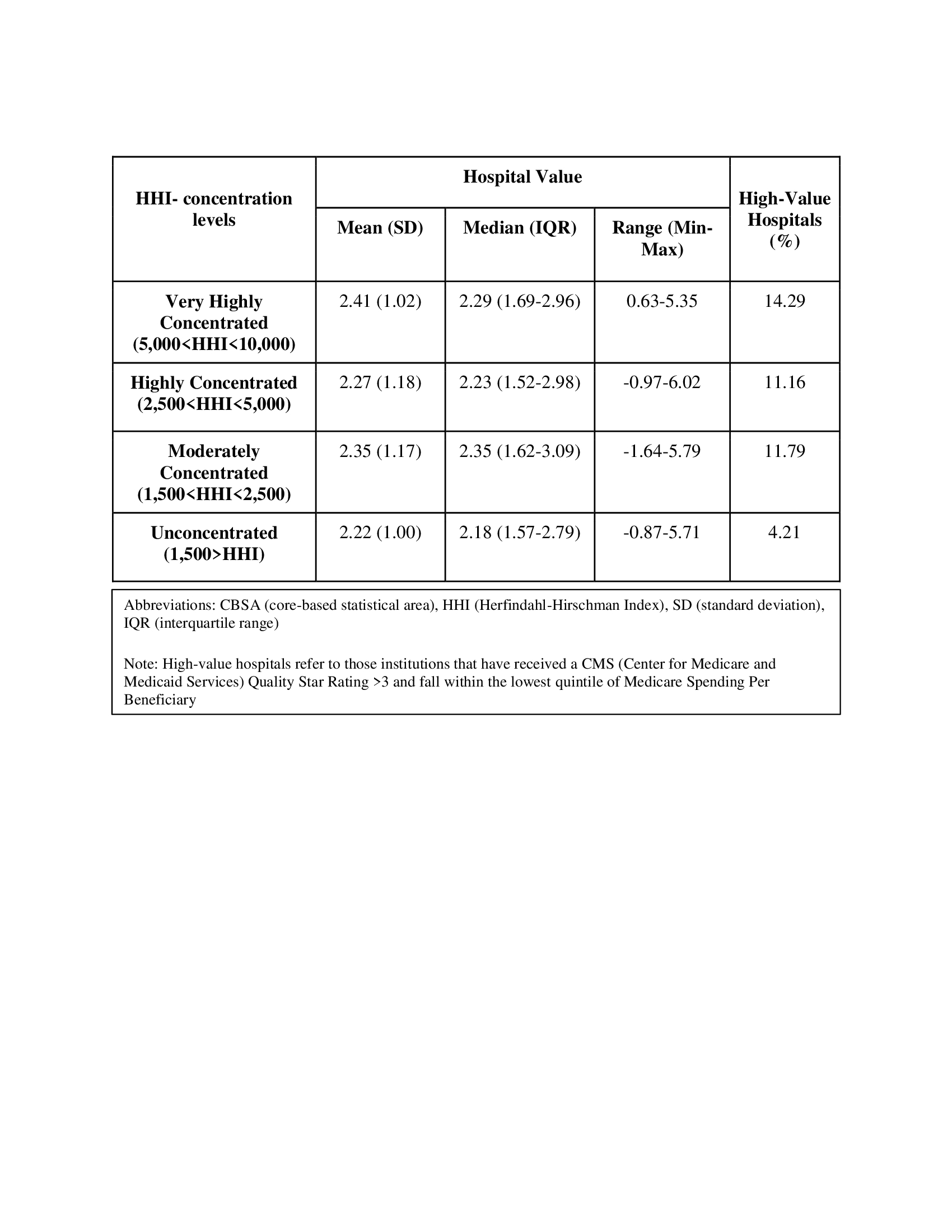

Results: Across 186 CBSAs, 3,131 hospitals in the United States were examined, with a mean and median number of hospitals per CBSA of 16.8 and 11, respectively. 125 (67.2%) CBSAs examined were highly or very highly concentrated. Mean hospital value was highest in very highly concentrated CBSAs (2.41), followed by moderately concentrated (2.35), highly concentrated (2.27) and lowest in unconcentrated regions (2.22). The highest percent of high value hospitals per concentration, as defined by >3 stars and MSPB in the top quintile, were in the very highly concentrated CBSA (14.29%) while the lowest was in the unconcentrated (4.21%) (table 1). In regression analyses including only HHI, there was no association with high value; after adjusting for hospital characteristics, the OR (95% CI) for high value associated with each 1000 point increases in HHI was 1.239 (1.004,1.530); P=0.045.

Conclusions: In contrast to concerns that increasing hospital market concentration negatively impacts healthcare value, our study found that unconcentrated markets yielded the lowest value hospitals. This may result from more concentrated hospital markets having synergies to better coordinate their care. Further studies should be done to include areas with fewer hospitals and smaller populations as well as alternative metrics of value.